business loans

Stó:lō Community Futures offers loans up to $150,000 for Indigenous entrepreneurs, and up to $500,000 for Stó:lō Community-owned businesses and/or their portions of joint-venture partnerships.

Please called SCF Business Analyst, Shannon Smith, to book a free & confidential appointment to discuss your business.

Please called SCF Business Analyst, Shannon Smith, to book a free & confidential appointment to discuss your business.

Click on arrow to scroll and view all programs.

-

ELIGIBILITY

-

MICRO-LOAN

-

INVESTMENT FUND

-

IMPACT FUND

-

EDP LOAN

-

EQUITY MATCH PROGRAM

-

GRANTS

<

>

ELIGIBILITY

To be eligible to apply for a business loan:

- Must be of Indigenous ancestry (Status, Non-Status, Métis, or Inuit).

- Must reside and operate business within S’ólh Téméxw, the Stó:lō Traditional Territory.

- Business must be at least 51% Indigenous-owned and/or controlled.

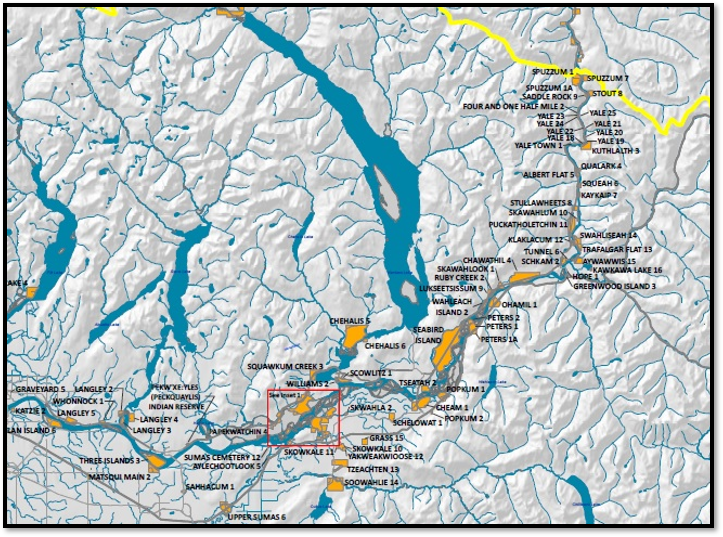

Service Area

|

Our service area is S’ólh Téméxw, the Stó:lō Traditional Territory, including Fort Langley to Yale on both sides of the Fraser River. We also serve all 24 Stó:lō communities and their affiliations, and all Indigenous entrepreneurs and Stó:lō Community-owned businesses in the towns, cities, and villages within S’ólh Téméxw.

Aitchelitz First Nation / Chawathil First Nation / Cheam First Nation

Kwantlen First Nation / Kwaw Kwaw Apilt First Nation Leq'á:mél First Nation / Matsqui First Nation / Peters Band Popkum First Nation / Seabird Island Band / Shxwhà:y Village Shxw'ow'hamel First Nation / Skawahlook First Nation Skowkale First Nation / Skwah First Nation / Soowahlie First Nation Sq’ewlets First Nation / Squiala First Nation / Sts’ailes Sumas First Nation / Tzeachten First Nation / Union Bar First Nation Yakweakwioose First Nation / Yale First Nation |

Indigenous impact lending fund

Through a capital partnership with Vancity, Stó:lō Community-owned businesses and/or their portions of joint-venture partnerships can access up to $500,000, and Indigenous businesses can access up to $150,000 for business start-up, growth or expansion.

Terms - Community-owned businesses

- Maximum Loan of $500,000 for viable Stó:lō community-owned businesses, their respective development corporations, for joint ventures with the private sector, or with another Stó:lō community(ies).

Terms - Indigenous businesses and entrepreneurs

- Maximum Loan of $150,000 for Indigenous entrepreneurs with new or existing businesses in S'ólh Téméxw.

Entrepreneurs with Disabilities Program (EDP)

The Entrepreneurs with Disabilities Program (EDP) funding is designed to assist entrepreneurs who self-identify with restricted ability to overcome barriers in business. There may be additional resources available with funding approved under this Program.

Terms:

Terms:

- Please make appointment to read about the Terms for this program.

Equity Match Program

In partnership with New Relationship Trust, SCF administers the Equity Match Program for the fiscal year of 2021-2022, which matches a portion of the required 15% equity component in grant funds. The grant is not offered as a stand-alone source of funding. It must be applied for in conjunction with a SCF Loan.

The grant is only available to BC First Nation individual entrepreneurs.

The grant is only available to BC First Nation individual entrepreneurs.

We encourage entrepreneurs to visit the following websites for helpful information:

Please note that SCF does not necessarily endorse any of the above resources, they are presented for informational purposes only.

application process

1. Set up a meetingContact and set up a meeting with the SCF Staff to share your business idea for start-up, expansion or maintenance. They will support you throughout the application process for adjudication by the Loan Funds Committee.

|

2. paperworkAs part of the business loan application, SCF Staff will guide you through a number of documents to be submitted, including:

|

3. reviewAdditional information may be requested before SCF Staff present your completed application to the the Loan Funds Committee, that make the approval decision. There may also be additional

information requested prior to finalizing the Committee's decision on your application. |

4. decisionOnce the Loan Funds Committee has made a decision, SCF Staff will contact you to notify of the outcome, explain the next steps, and complete the documentation.

|

5. business support

SCF Staff continues to work with you and explore additional resources throughout your journey. At any time you need someone to talk to regarding your business, SCF is available to support any area you may need help with.

we are here for you.

business loan evaluation

The SCF Staff are here to support you through the business loan application. Your application is reviewed on the following criteria, and the staff will support you in ensuring your application demonstrates the following:

|

|